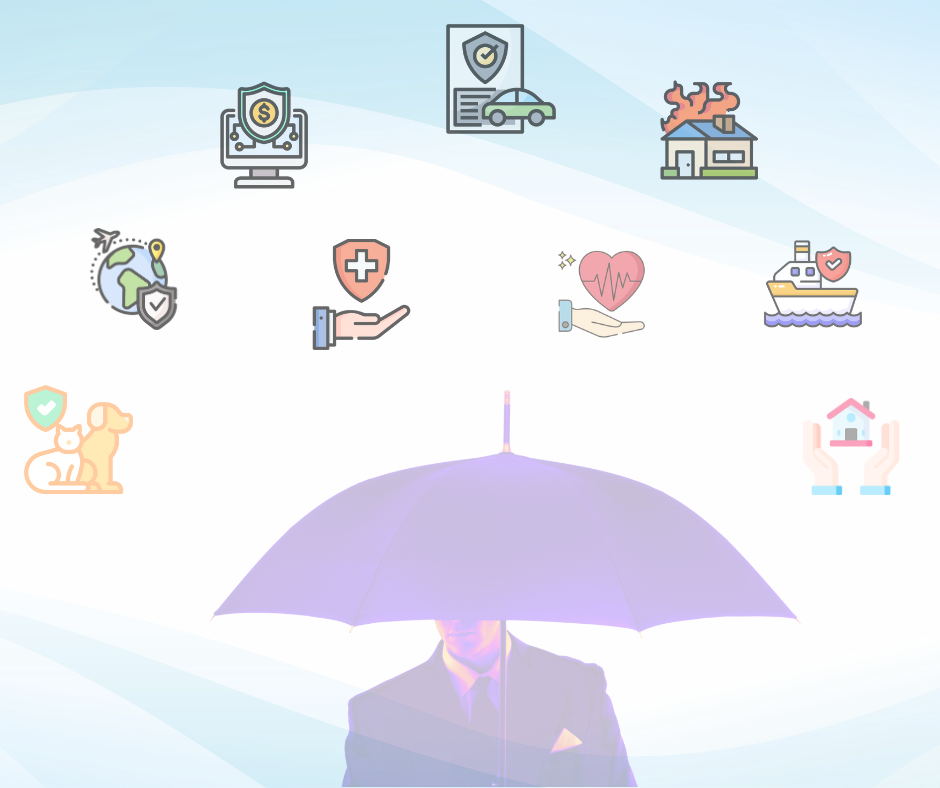

All Insurance Services under one roof

We provide various types of insurance services

along with risk assessment & claim

consultation services

Consulting

We as 3Di Insurance brokers, provide expert advice and guidance to individuals, businesses, or organizations seeking assistance with various aspects of insurance. We assess clients' risks, analyze existing insurance policies, and recommend appropriate coverage options tailored to their needs. 3Di Insurance brokers helps clients navigate the complex landscape of insurance products and regulations, ensuring compliance with legal requirements and industry standards. Additionally, We assist with claims management, risk mitigation strategies, and market insights, empowering our clients to make informed decisions to protect their assets and mitigate potential losses. Whether it's optimizing coverage, negotiating with insurers, or implementing risk management measures, 3Di Insurance brokers play a vital role in helping clients achieve their insurance objectives effectively and efficiently.

General Insurance

Health Insurance

Health insurance provides individuals with financial coverage for medical expenses incurred due to illness, injury, or preventive care. It serves as a crucial safeguard against the high costs of healthcare, offering peace of mind and access to essential medical services. Health insurance plans vary widely in coverage and cost, ranging from basic plans that cover essential services to comprehensive plans that include additional benefits such as prescription drug coverage and mental health services. We can assist you in choosing the right product/customized according to your needs through PSU or private insurers. By pooling risk and spreading the financial burden of healthcare expenses across a large group of policyholders, health insurance helps ensure that individuals have access to the care they need without facing financial hardship. It promotes healthier outcomes by encouraging regular preventive care and timely medical treatment, ultimately improving the overall well-being and quality of life for individuals and communities.

Motor

3Di Insurance brokers play a pivotal role in facilitating motor insurance by acting as intermediaries between insurance companies and policyholders. Their expertise lies in assessing the unique needs of individuals or businesses seeking motor insurance coverage and matching them with the most suitable policies available in the market. We provide personalized advice, helping clients understand their coverage options, policy terms, and exclusions, ensuring they make informed decisions. We navigate the complexities of the insurance market, negotiating with insurers on behalf of clients to secure competitive premiums and comprehensive coverage tailored to their specific requirements. Additionally, insurance brokers assist clients throughout the policy lifecycle, from initial consultation and policy selection to claims assistance and policy renewals.

Travel

3Di Insurance brokers serve as essential intermediaries in facilitating travel insurance, offering expertise and guidance to travellers seeking financial protection during their journeys. With their in-depth knowledge of the insurance market, brokers assess travelers' specific needs and risks associated with their trips, helping them navigate the complexities of travel insurance policies. We provide personalized advice, recommending suitable coverage options tailored to travelers' destinations, activities, and duration of stay, ensuring comprehensive protection against potential risks such as trip cancellations, medical emergencies, or lost baggage. We act as advocates for travelers, negotiating with insurers to secure competitive premiums and favourable terms on your behalf. Additionally, We assist travelers throughout the policy lifecycle, from policy selection and purchase to claims assistance and policy renewals.

Property

3Di insurance brokers serve as invaluable partners for property owners and businesses seeking comprehensive coverage to protect their assets against various risks. Leveraging their expertise in risk assessment and insurance products, We assess the unique needs and exposures of clients, guiding them through the intricacies of property insurance policies and helping them select the most appropriate coverage options. 3Di insurance brokers provide personalized advice, analyzing factors such as property value, location, occupancy, and vulnerability to natural disasters or other perils to ensure clients obtain adequate protection. Additionally, we negotiate with insurers to secure competitive premiums and favourable policy terms, advocating for clients' best interests. Throughout the policy lifecycle, from policy inception to claims processing, 3Di insurance brokers offer ongoing support and assistance, serving as trusted advisors and advocates to help property owners navigate the complexities of property insurance effectively and safeguard their investments against unforeseen losses or damages.

Life

Cyber

3 Dimensional Insurance Brokers India is selling Bodyguard Bulletproof, a unique offering of Cyber Security (Bodyguard is an Israeli based military grade security application for the Mobiles and tablets) bundled with cyber insurance, so as to create a win-win situation for all the stakeholders:

1. The customer- The end consumers get 360* protection with military grade cyber security for their mobile devices and cyber insurance coverage against all of their digital assets.

2. The Insurance Company – The insurance policy is strengthened with the unique cyber security offering brought by SafeHouse and can reach a wider audience. Additionally, BodyGuard by SafeHouse, reduces the the risk of liability of the insurance company significantly

3. SafeHouse Technologies (Bodyguard) ‐ 80% of the web traffic in India is through mobiles and BodyGuard secures this traffic by detecting and preventing cyber threats in real-time.

Currently, we have bundled the product with Bajaj Allianz Cyber Safe Policy.

1. The customer- The end consumers get 360* protection with military grade cyber security for their mobile devices and cyber insurance coverage against all of their digital assets.

2. The Insurance Company – The insurance policy is strengthened with the unique cyber security offering brought by SafeHouse and can reach a wider audience. Additionally, BodyGuard by SafeHouse, reduces the the risk of liability of the insurance company significantly

3. SafeHouse Technologies (Bodyguard) ‐ 80% of the web traffic in India is through mobiles and BodyGuard secures this traffic by detecting and preventing cyber threats in real-time.

Currently, we have bundled the product with Bajaj Allianz Cyber Safe Policy.

Crop

3Di Insurance brokers facilitate crop insurance by serving as intermediaries between farmers and insurance providers. Leveraging their expertise in risk management and insurance products, brokers assist farmers in understanding the complexities of crop insurance policies and identifying the most suitable coverage options tailored to their specific agricultural operations and risks. As crop insurance is government aided, We closely work with Insurers and Banks for the crop insurance. We do the collection of data, crop surveys, crop cutting experiments and upload all data to Insurers and Govt website.In case of unforeseen events and perils we guide farmers through the claims process, providing support and advocacy to ensure timely and fair compensation in the event of crop losses or damages.

Cargo

We at 3Di insurance brokers assess the unique risks associated with transporting goods, including potential damage, theft, or loss during transit, and provide tailored solutions to mitigate these risks effectively. Leveraging their knowledge of insurance products and the transportation industry, we help clients navigate the complexities of cargo insurance policies, ensuring they obtain adequate coverage to protect their shipments. We also assist clients in understanding policy terms, coverage limits, and exclusions, empowering them to make informed decisions that align with their specific needs and risk tolerance. Furthermore, we leverage our relationships with insurers to negotiate competitive premiums and favourable policy terms on behalf of clients.

Fire

In fire insurance, 3Di insurance brokers offer significant value addition by serving as knowledgeable advisors and advocates for property owners seeking comprehensive coverage to protect against the devastating effects of fire-related losses. Leveraging their expertise in risk assessment and insurance products, brokers carefully evaluate the unique risks and vulnerabilities of clients' properties, providing tailored recommendations to ensure adequate coverage. We assist clients in understanding the intricacies of fire insurance policies, including coverage limits, exclusions, and additional protections such as business interruption coverage. We leverage our relationships with insurance providers to negotiate competitive premiums and favourable policy terms on behalf of our clients, advocating for their best interests.

Reinsurance

"Reinsurance is the transfer of part of the hazards or risks that a direct insurer assumes by way of insurance contracts on behalf of an insured, to a second insurance carrier, the reinsurer, who has no direct contractual relationship with the insured.”

Reinsurance can be classified in the following ways:

Proportional or Non-proportional - depending on the way the risks, the premium and the losses are shared between the insurer who is sharing his business and the reinsurer who is accepting it.

Treaty or Facultative - depending on how the contract is administered, either on an individual basis with offer and acceptance for each individual risk or on some kind of automatic agreements for various risks over a stipulated period of time.

Inward or Outward - depending on whether reinsurance is being accepted or given out.

Treaty or Facultative - depending on how the contract is administered, either on an individual basis with offer and acceptance for each individual risk or on some kind of automatic agreements for various risks over a stipulated period of time.

Inward or Outward - depending on whether reinsurance is being accepted or given out.

This is Reinsurance effected on a case to case basis. When a risk is too large for the insurer to retain, he offers to share the risk with other reinsurers. Neither the ceding company nor the reinsurer is under any obligation to cede or to accept any risk. In case of proportional facultative reinsurance, the interested reinsurers who agree to take shares of the risk are then paid the corresponding share of the premium less the reinsurance commission. In case of losses, they agree to share the same in proportion to the share of premium given to them. In case of non-proportional facultative reinsurance, the reinsurers agree to pay for losses once they exceed an agreed deductible. In such a case, the premium is not shared on a proportional basis but on some other agreed basis depending on the risk. Originally, all reinsurances were done facultatively but soon this was found to involve too much of administrative costs and was later supplemented by automatic agreements called treaties. Today, facultative reinsurance is usually resorted to reinsure risks for which automatic treaties either do not exist or are not adequate. It therefore allows for increased capacity as and when required. It is also used for reinsurance of specialized types of risks which are handled by certain reinsurers only.

This is a standing arrangement where the ceding insurer has an obligation to cede all risks that fall within the purview of the arrangement and the reinsurer is under an obligation to accept all that is ceded. Thus, Treaty reinsurance consists of an agreement between the original insurer and reinsurer whereby the reinsurer automatically accepts a certain liability for all risks falling within the scope of the agreement. Treaty reinsurance may be transacted either on proportional basis or non-proportional basis.

A formal treaty wording is usually drawn up by the parties to describe:

1. the monetary limits and mode of operation

2. the classes of business covered, the territorial scope, the risks excluded

3. the calculation and payment of premiums, the calculation and payment of claims and the period of agreement

4. the commissions, including profit commissions, payable to the insurer

5. the rendering of reinsurance accounts to the reinsurer and settlements thereof

Since treaty reinsurance provides automatic cover, usually for a year, the insurer is guaranteed a definite amount of reinsurance protection on every risk which he accepts. The administrative costs are therefore much lower than those applying to facultative reinsurance.

A formal treaty wording is usually drawn up by the parties to describe:

1. the monetary limits and mode of operation

2. the classes of business covered, the territorial scope, the risks excluded

3. the calculation and payment of premiums, the calculation and payment of claims and the period of agreement

4. the commissions, including profit commissions, payable to the insurer

5. the rendering of reinsurance accounts to the reinsurer and settlements thereof

Since treaty reinsurance provides automatic cover, usually for a year, the insurer is guaranteed a definite amount of reinsurance protection on every risk which he accepts. The administrative costs are therefore much lower than those applying to facultative reinsurance.

In this type of reinsurance, the insurer and reinsurer share the risk, the premium as well as the losses in an agreed proportion. The premium and claims are divided in the same proportion as the risk is. Thus if the reinsurer shares 60% of the risk, he is paid 60% of the original premium and he also shares 60% of all losses pertaining to the risk. However, the insurer who shares this business is compensated for his acquisition costs by way of an agreed commission which is his income.

Quota share treaties, the obligatory cessions, surplus treaties, the market surplus treaty, the pool arrangements, the intercompany cessions and the Auto fac arrangements all fall within this definition

We aUnder this type of reinsurance arrangements, the risks, premiums and losses are not shared on a proportional basis. Rather, this type of reinsurance seeks to protect the losses of the insurer by the reinsurer on an agreed basis. In other words, the reinsurer agrees to pay losses sustained by the insurer above an agreed amount or percentage called a deductible. Such losses may be in relation to a particular risk or many risks in a particular class of risk or even all risks of the insurer by the reinsurer. Of course, such reinsurance comes at a cost for which the reinsurer is paid a reinsurance premium on some agreed basis. Risk Excess of Loss, Catastrophe Excess of Loss, Stop Loss, Aggregate Excess of Loss, Umbrella Excess of Loss etc. fall within this type of reinsurance.

This is an arrangement where the ceding insurer (reinsured) can choose which risks he wants to cede to the arrangement but the reinsurer has no option to choose – he agrees to accept all that is ceded.

This form of reinsurance is therefore a combination of facultative and treaty forms. At present this type of treaty is not common though one would come across such arrangement in life reassurance. It can be placed during weak reinsurance market conditions or for getting additional capacity but cannot be relied upon as a primary reinsurance.

This form of reinsurance is therefore a combination of facultative and treaty forms. At present this type of treaty is not common though one would come across such arrangement in life reassurance. It can be placed during weak reinsurance market conditions or for getting additional capacity but cannot be relied upon as a primary reinsurance.

Life Insurance

Term Life

Term life insurance, also known as pure life insurance, is life insurance that guarantees payment of a death benefit during a specified term. Once the term expires, the policyholder can either renew for another term, convert to permanent coverage, or allow the policy to terminate. Term life insurance policies provide a stated benefit upon the death of the insured, provided that the death occurs within a specific period.

Term life policies have no value other than the guaranteed death benefit. There is no savings component as is found in a whole life insurance product. The policy's purpose is to give insurance to individuals against the loss of life. All premiums cover the cost of underwriting the insurance. As a result, term life premiums are typically lower than permanent life insurance premiums

Term life policies have no value other than the guaranteed death benefit. There is no savings component as is found in a whole life insurance product. The policy's purpose is to give insurance to individuals against the loss of life. All premiums cover the cost of underwriting the insurance. As a result, term life premiums are typically lower than permanent life insurance premiums

Endowment Policy

Endowment Life Insurance Provides Two Products for the Price of One

These policies couple term life insurance with a savings program. As the policyholder, you choose how much you want to save each month and when you want the policy to mature. Based on your monthly contributions, you're guaranteed a certain payout, called an endowment, when the policy matures. You can then use this endowment for your child's college tuition, fees, books, living expenses and other costs. If you should die before the policy matures, your child will receive the payout as your death benefit and will still have the anticipated money for college.

The endowment life insurance policy promises a risk-free, guaranteed return on a guaranteed date as long as you make the fixed monthly payments.

These policies couple term life insurance with a savings program. As the policyholder, you choose how much you want to save each month and when you want the policy to mature. Based on your monthly contributions, you're guaranteed a certain payout, called an endowment, when the policy matures. You can then use this endowment for your child's college tuition, fees, books, living expenses and other costs. If you should die before the policy matures, your child will receive the payout as your death benefit and will still have the anticipated money for college.

The endowment life insurance policy promises a risk-free, guaranteed return on a guaranteed date as long as you make the fixed monthly payments.

Key Man Insurance

A life insurance policy that a company purchases on a key executive's life. The company is the beneficiary of the plan and pays the insurance policy premiums.

Key person insurance is needed if the sudden loss of a key executive would have a large negative effect on the company's operations. The payout provided from the death of the executive essentially buys the company time to find a new person or to implement other strategies to save the business.

In a small business, the key person is usually the owner, the founders or perhaps a key employee or two. The main qualifying point would be if the person's absence would sink the company. If this is the case, key person insurance is definitely worth consideration.

How Keyman Insurance Works

For key person insurance policies, a company purchases a life insurance policy on its key employee(s), pays the premiums and is the beneficiary of the policy. In the event of death, the company receives the insurance payoff. These funds can be used for expenses until it can find a replacement person, pay off debts, distribute money to investors, pay severance to employees and close the business down in an orderly manner. In a tragic situation, key person insurance gives the company some options other than immediate bankruptcy.

Key person insurance is needed if the sudden loss of a key executive would have a large negative effect on the company's operations. The payout provided from the death of the executive essentially buys the company time to find a new person or to implement other strategies to save the business.

In a small business, the key person is usually the owner, the founders or perhaps a key employee or two. The main qualifying point would be if the person's absence would sink the company. If this is the case, key person insurance is definitely worth consideration.

How Keyman Insurance Works

For key person insurance policies, a company purchases a life insurance policy on its key employee(s), pays the premiums and is the beneficiary of the policy. In the event of death, the company receives the insurance payoff. These funds can be used for expenses until it can find a replacement person, pay off debts, distribute money to investors, pay severance to employees and close the business down in an orderly manner. In a tragic situation, key person insurance gives the company some options other than immediate bankruptcy.

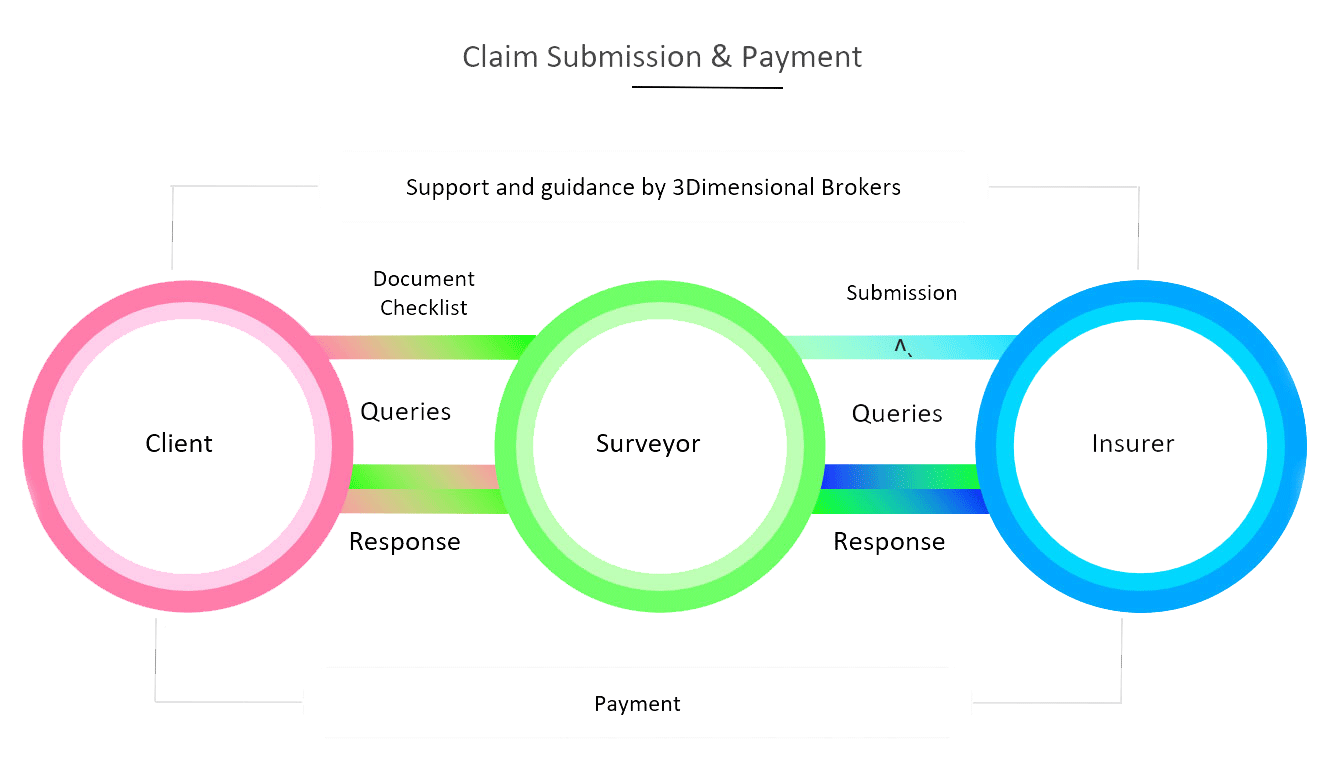

How we Get a Quote

How we Service